Small and Medium Enterprises Services

Corporate Finance and Capital Structure Decisions

Advising companies of the optimal mix of debt (bond issues or bank loans) and equity (preferred or common) also (either financed from retained earnings or the issuance of new shares) that produces the lowest weighted average cost of capital (WACC) in order to maximize the value of the company and provide the flexibility for potential growth.

Management Consultancy

Support businesses improve their performance and grow by solving problems and finding new and better ways of doing things. Help develop their services and reduce costs.Our consultants also provide organizational change management assistance, development of coaching skills, process analysis, technology implementation, strategy development, or operational improvement services. Management consultants often bring their own proprietary methodologies or frameworks to guide the identification of problems, and to serve as the basis for recommendations for more effective or efficient ways of performing work tasks.

Investment Advisory

Providing investment recommendations for clients about the investment instruments, asset classes and markets that suit their financial position, income requirement and liquidity preferences, also conducting securities analysis and issuing reports for the recommended investment instruments.

Cash Management Consulting

Advising companies to manage their excess cash and invest in short term financial instruments in order to best utilize the funds in addition to maintain the appropriate level of liquidity for company`s operations. Moreover advising companies about how to use short term financing tools efficiently when needed.

Working Capital Optimization

The key objective of working capital management is to define and maintain the necessary level of working capital for the ongoing company’s operations and its solvency in the short term. Efficient working capital management is an essential factor for the successful development of the company.

Services Provided:

finding the optimal structure of current assets, management of accounts receivable, inventory and other elements of current assets, calculation of the highest possible level of short-term investments, management of accounts payable and management of short-term funding sources.

Financial Valuation

Valuation is the analytical process of determining the current (or projected) worth of an asset or a company.

Providing company valuation for the purpose of either selling / merging / acquisition of a company or for financial reporting purposes using different financial valuation techniques.

Business Expansion Strategies

The Expansion Strategy is adopted by an organization when it attempts to achieve a high growth as compared to its past achievements. The firm can follow either of the five expansion strategies to accomplish its objectives: Expansion through Concentration or Expansion through Diversification

Market Research

Determining the viability of a new service or product through research conducted directly with potential customers. Market research allows a company to discover the target market and get opinions and other feedback from consumers about their interest in the product or service.

Feasibility Studies

A feasibility study is an assessment of the practicality of a proposed plan or project. Feasibility studies ask: Is this project feasible? Do we have the people, tools, technology, and resources necessary for this project to succeed? Will the project get us the return on investment (ROI) that we need and expect?

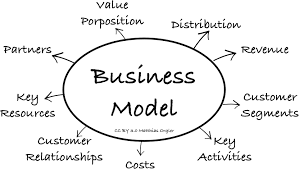

Business Modeling

A business model describes the rationale of how an organization creates, delivers, and captures value, in economic, social, cultural or other contexts. The process of business model construction and modification is also called business model innovation and forms a part of business strategy